The estate of a North Carolina local might be provided in the county where she or he was domiciled at the time of death. If a nonresident driver died in any kind of North Carolina area, the estate may be provided in any type of North Carolina county. Executors, managers, personal reps, and trustees are all titles of «fiduciaries». A fiduciary is someone in a position of trust fund and authority to manage residential property for the benefit of another. » Executors» are the fiduciaries selected under a will and provided authority by the court.

Can I Obtain A Refund If My Etias Traveling Authorisation Application Is Unsuccessful?

Having the traveling authorisation only enables you to go into and remain on the territory of the European countries calling for ETIAS for a short-term stay. If the plan consists of both pre-1987 and post 1987 amounts, for circulations of any type of quantities in excess of the age 70 1/2 RMDs, the unwanted is considered to be from the pre-1987 quantities. The account owner is tired at their revenue tax obligation rate on the amount of the withdrawn RMD. Nonetheless, to the extent the RMD is a return of basis or is a professional circulation from a Roth IRA, Jaclyn Sharkey it is free of tax. You should take your first required minimal distribution for the year in which you reach age 72 (73 if you reach age 72 after Dec. 31, 2022).

When somebody passes away, some or every one of the dead individual’s building may transfer directly to others as a result of legal setups made by the deceased person before fatality. Each nation (and occasionally various jurisdictions within the country) have various inheritance legal rights. If there are no kids, the near relative relationship remains to discover the closest living relative.

With the exception of testamentary counts on, the majority of count on instruments are not submitted with a court. Estate administration is a process for managing an individual’s possessions and debts after that individual’s fatality. Some estates are administered by «complete management.» Lots of little estates may be administered with simpler processes. Unless the decedent established total alternatives to court-supervised estate management prior to death, estate administration is taken care of via the courts, primarily in the workplace of the appropriate staff of exceptional court. Certain various other policies relate to people that inherit retirement possessions.

When minors wish to do a juristic act, they need to acquire the consent from their lawful rep, normally (however not constantly) the parents and or else the act is voidable. The exceptions are acts through which a minor merely acquires a right or is devoid of a duty, acts that are strictly individual, and acts that appropriate to the individual’s problem in life and are required for their affordable requirements. In several countries, consisting of Australia, Serbia, [3] India, Brazil, Croatia, Colombia, and the UK a minor is defined as an individual under the age of 18. In the USA, where the age of bulk is set by private states, «small» typically refers to somebody under 18 yet can in some locations (such as alcohol, gambling, and hand guns) imply under 21. In the criminal justice system a minor may be attempted and penalized either «as an adolescent» or «as a grown-up». The initial repercussion of passing away intestate might be a shock for your making it through enjoyed ones— friends and family are often stunned to learn you didn’t have a will

Only emancipation confers the condition of maturation before a person has in fact reached the age of bulk. A trust fund is a lawful relationship through which one person or entity holds title to residential property for the advantage of an additional person or entity. In many trust fund partnerships, the regards to the trust are set out in a composed record called a trust fund tool.

As you approach old age, you will absolutely intend to have a will, yet at what age should you have a will in place? Despite your age, it may remain in your benefit to make a will. There are numerous variables that you can consider when deciding whether you need to make a will.

Whether you are preparing to consult with your lawyer or to carry out the estate on your own, there are certain papers to collect and steps to take. This indicates that the proceeds from life insurance plans and pension are moved to the beneficiaries named by a decedent, also if the decedent designates different individuals in their will. An additional essential distinction between near relative and power of attorney is the level of control and authority each provides.

Next, your witnesses should acknowledge that they’re seeing your Last Will and Testament. They have to preliminary each page (next to the testator’s initials) and sign and fill in the called for details on the signing page of the Will. If there are specific things (such as treasure jewelry or the family members home) that you desire to present on a specific person, be sure to claim so in your Will. If you have minor recipients, LawDepot’s Last Will and Testament template allows you to add a term for delaying their inheritance till they reach a certain age. Edward A. Haman is a freelance author, that is the writer of various self-help lawful books. Among those examined services, Trust fund & Will was our top «Editor’s Select.» Next off, we picked LegalZoom, Quicken WillMaker & Trust fund, complied with by Rocket Lawyer, and U.S.

Next, your witnesses should acknowledge that they’re seeing your Last Will and Testament. They have to preliminary each page (next to the testator’s initials) and sign and fill in the called for details on the signing page of the Will. If there are specific things (such as treasure jewelry or the family members home) that you desire to present on a specific person, be sure to claim so in your Will. If you have minor recipients, LawDepot’s Last Will and Testament template allows you to add a term for delaying their inheritance till they reach a certain age. Edward A. Haman is a freelance author, that is the writer of various self-help lawful books. Among those examined services, Trust fund & Will was our top «Editor’s Select.» Next off, we picked LegalZoom, Quicken WillMaker & Trust fund, complied with by Rocket Lawyer, and U.S.

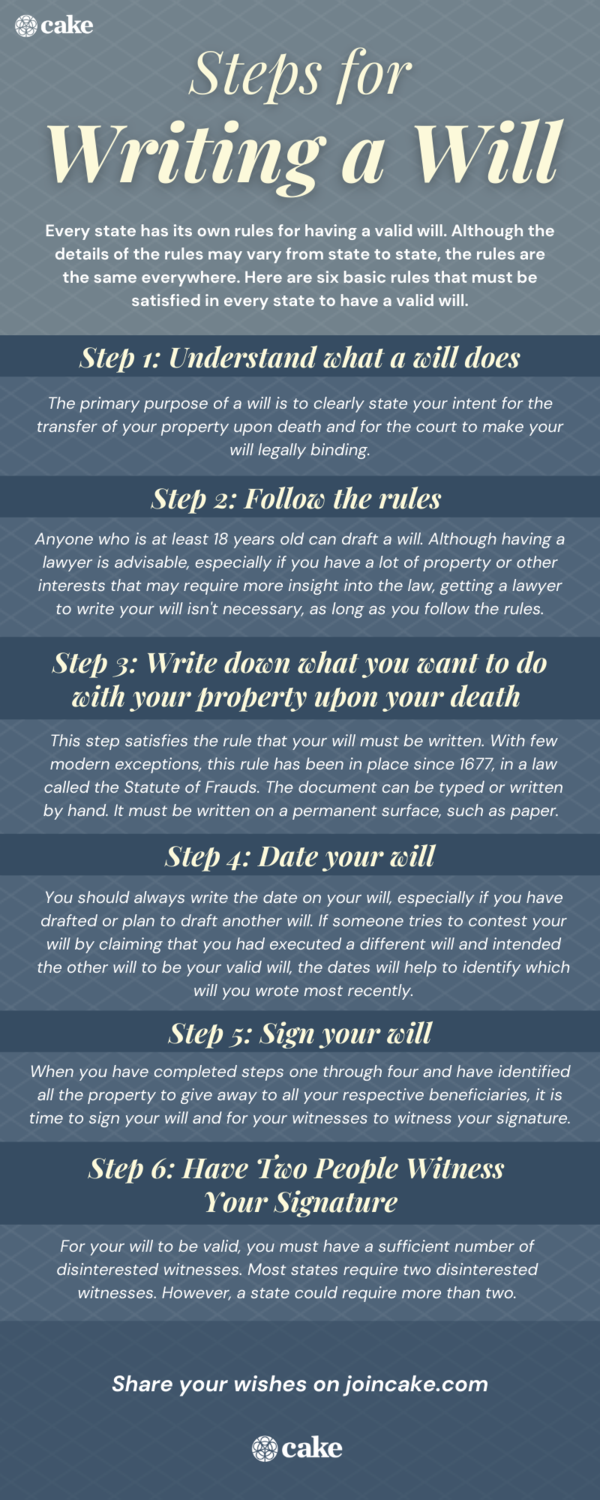

Use a simple will to provide your assets and the beneficiaries who must obtain them. You can also mark the executor and a guardian for any type of minor youngsters. Writing a will is also a challenging topic that can drum up difficult emotions such as the anxiety of the unidentified. Therefore, estate planning often gets bumped to the base of the to-do list.

This reveals authorization of the property circulation plan and licenses this is the last will and testimony. Ultimately, you need to contend least two witnesses when you sign the will. These witnesses attest, or confirm, the testator was of sound mind when they were producing their will and the testator’s trademark is their own. While you can keep your last will and testament in a refuge at home, you need to ensure these estate intending documents outlast you. We suggest taking extra preventative measures, such as making use of a fireproof lockbox (such as this one for $30) or a secure down payment box at the bank.

This area will certainly outline the power given to your executors and trustees when managing your monetary events. These powers can consist of the capacity to offer property and properties, to pay taxes, to distribute properties to recipients, to invest money, and to clear up any cases versus the estate. When you develop a will making use of Willful, we ask you a collection of inquiries to guarantee your legal file is tailored to your life scenario.

Various other jurisdictions will either neglect the effort or hold that the entire will certainly was really withdrawed. A testator may likewise have the ability to withdraw by the physical act of an additional (as would certainly be required if she or he is physically paralyzed), if this is done in their visibility and in the presence of witnesses. Some jurisdictions might assume that a will has been destroyed if it had actually been last seen in the property of the testator but is located mutilated or can not be located after their fatality. Our company believe it is so essential to plan and get one’s economic affairs in order that we have partnered with FreeWill.com so that you can develop your will online— entirely absolutely free. Make certain that the named recipients in all of your financial and insurance accounts match the names in your will.

The net estate is inclusive of home that passed by the regulations of intestacy, testamentary residential property, and testamentary substitutes, as enumerated in EPTL 5-1.1-A. New York’s classification of testamentary substitutes that are consisted of in the net estate make it challenging for a deceased partner to disinherit their enduring spouse. In area home territories, a will can not be used to disinherit a making it through spouse, who is qualified to a minimum of a part of the testator’s estate. For the distribution (devolution) of residential property not established by a will, see inheritance and intestacy.

To appropriately execute your Will, you must authorize the paper in the visibility of two witnesses. After noting certain gifts, you can name the recipients who will certainly acquire the remainder of your estate. Your beneficiaries are the individuals, organisations, or charities that will certainly take advantage of your Will certainly by acquiring residential property or sentimental gifts. Include the names of any type of children you have and define whether they’re minors or adult dependents.